According to sources, Ather Energy is nearing completion of plans to secure $75-90 million (about Rs 750 crore) in primary funding from current investors, highlighting growing investor enthusiasm in both the company and the mobility sector. Ather is also reaching out to potential new investors.

Ather Energy’s Funding Endeavors and Shareholder Changes

Its Energy, the electric two-wheeler manufacturer, is negotiating a “substantial funding round” involving both primary and secondary share sales, according to informed sources.

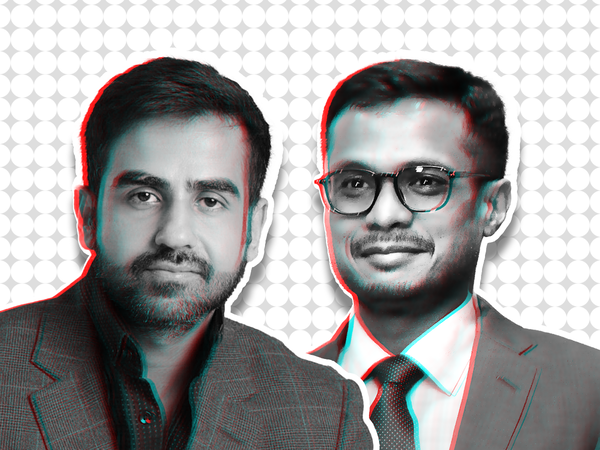

Flipkart cofounder Sachin Bansal, an existing investor, has reportedly divested a considerable portion of his stake in the company to Zerodha cofounder Nikhil Kamath. Sources suggest Kamath might acquire Bansal’s remaining shares in the firm.

According to sources, Ather Energy is in the final stages of securing $75-90 million (about Rs 750 crore) in primary funding from current investors, highlighting growing investor interest in both the company and the mobility sector. The company is also reaching out to potential new investors.

“One of the individuals, who preferred not to be identified, stated that the structure of the primary funding round is still being determined but is expected to amount to approximately $75-90 million in total.”

According to insiders, an existing investor might spearhead the funding round, potentially valuing Ather Energy between $850 million and $1 billion. If successful at securing primary capital at a $1 billion valuation, it would join the ranks of unicorns, startups valued at $1 billion or more.

According to Tracxn data, Bansal, Ather Energy’s inaugural angel investor, possessed a 10.7% stake in the company. Since 2014, he has injected nearly Rs 400 crore. Binny Bansal, Flipkart’s cofounder, is also an investor, holding a 1% stake. Kamath confirmed his investment to ET, stating, “Among my private equity investments, this will be among the largest bets that I have made… I truly believe in the product and I am looking to have a good amount of exposure to Ather for the next decade.”

Ather Energy’s Recent Developments and Expansion Plans

In reply to an emailed query from ET, a representative for Bansal stated, “We have no comment to provide.” A spokesperson for Ather Energy refrained from commenting on the primary funding arrangements. In a secondary transaction, a new investor acquires shares from an existing investor, with the capital not being directed to the company’s funds.

Ather Energy delayed funding plans last year due to unfavorable market conditions. Instead, it conducted a rights issue in September 2023, raising Rs 900 crore from Hero MotoCorp and GIC. National Investment and Infrastructure Fund and Tiger Global are also investors. In December, HeroMotoCorp boosted its stake to 39.7% with an additional investment of Rs 140 crore. The sellers of shares during the December funding were not disclosed by Ather Energy.

Ather Energy introduced the ‘Rizta’ scooter range on April 6, aimed at the family segment. With a current production capacity of 450,000 scooters annually, the company plans to increase production from the current 150,000 vehicles per year following the Rizta’s launch.

You might also be interested in – Adani Green is poised for a significant investment, aiming to inject Rs 2 lakh crore into renewable energy by 2030.