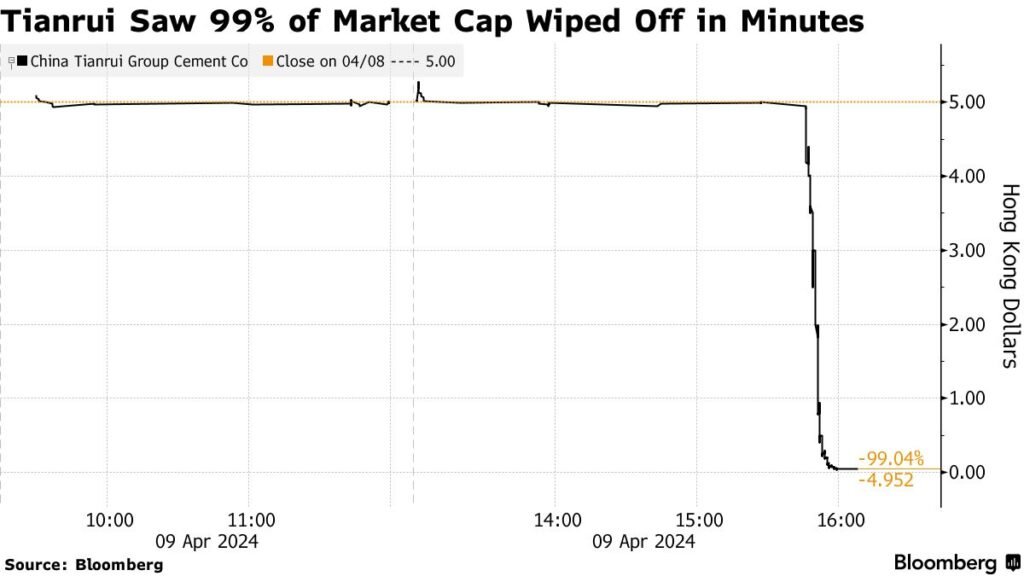

A Chinese cement producer garnered attention as it halted stock trading Wednesday due to a rapid selloff, nearly erasing its entire market value in the last 15 minutes of the previous session.

China Tianrui Group Cement Co. announcement

China Tianrui Group Cement Co. announced a trading halt for its Hong Kong-listed shares at 9 a.m. local time, pending an inside information-related announcement, as per an exchange filing.

Tianrui, headquartered in Henan province, saw its stock plummet 99% to approximately HK$0.05 on Tuesday, slashing its market cap to HK$141 million ($18 million). During the selloff, around 281 million shares, equivalent to a third of the firm’s free float, were traded. Of these, over 80 million shares were exchanged in the closing auction.

Tianrui’s sudden stock plunge highlights risks tied to obscure Chinese firms with concentrated shareholding and those leveraging shares for debt. Amidst an unprecedented housing crisis, the struggling company’s challenges amplify pressures on property developers and construction firms.

Kay Hian Observation

Steven Leung, executive director at UOB Kay Hian in Hong Kong, noted that when encountering sizable selling orders, panic can ensue due to limited buyers, particularly affecting penny stocks with low liquidity. He added that such plunges might also stem from margin calls if major shareholders have pledged their stocks.

Per a January filing, Tianrui’s majority shareholder Li Liufa and spouse collectively hold about 70% ownership. The company also disclosed pledging 97 million shares, equivalent to 3.3% of its total, to secure a 12-month loan of up to 166.5 million yuan.

Bloomberg couldn’t reach the company’s investor relations officials for comment. Additionally, there was no immediate response to a written request for comment.

Net loss

Tianrui reported a net loss of 634 million yuan ($87.7 million) last year, compared to a profit of 449 million yuan in 2022. Reasons cited include weak demand due to China’s property downturn, increased market competition, and high raw material costs.

The company, listed in Hong Kong since 2011, boasts an annual cement output capacity of roughly 58 million tons, primarily serving central and northern China, as per its official website. It highlights product usage in key domestic infrastructure projects like high-speed rail lines.

You might also be interested in: Fitch revises China’s outlook to negative due to economic growth concerns.

2 comments

[…] You might also be interested in: Trading Halt as Chinese Cement Maker’s Shares Plummet 99% in 15 Minutes […]

[…] You might also be interested in: Trading Halt as Chinese Cement Maker’s Shares Plummet 99% in 15 Minutes […]