Investing in stocks can be a rewarding way to grow your wealth, but it can also be daunting, especially for new investors. One of the most effective ways to assess a company’s financial health and potential for growth is by analyzing key financial ratios. These ratios provide insights into various aspects of a company’s performance, making it easier to make informed investment decisions. In this blog, we will explore essential ratios that every investor should know before investing in a stock, helping you to evaluate potential investments effectively.

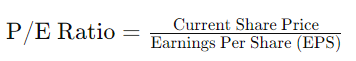

1. Price-to-Earnings (P/E) Ratio

What is it?

The Price-to-Earnings (P/E) ratio is one of the most commonly used metrics to assess a company’s valuation. It measures a company’s current share price relative to its earnings per share (EPS).

How to Calculate It:

Why It Matters:

A high P/E ratio may indicate that a stock is overvalued or that investors are expecting high growth rates in the future. Conversely, a low P/E ratio may suggest that the stock is undervalued or that the company is facing challenges. Comparing the P/E ratio of a company to its industry average can provide further insights into its valuation.

2. Price-to-Book (P/B) Ratio

What is it?

The Price-to-Book (P/B) ratio compares a company’s market value to its book value, which is the value of its assets minus its liabilities.

How to Calculate It:

Why It Matters:

A P/B ratio of less than 1 can indicate that the stock is undervalued relative to its book value, suggesting a potential buying opportunity. However, a very low P/B ratio could also signal underlying issues within the company, so it’s essential to conduct further analysis.

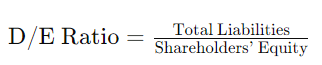

3. Debt-to-Equity (D/E) Ratio

What is it?

The Debt-to-Equity (D/E) ratio measures a company’s financial leverage by comparing its total liabilities to its shareholders’ equity.

How to Calculate It:

Why It Matters:

A high D/E ratio indicates that a company is heavily reliant on debt to finance its operations, which can increase risk, especially in volatile markets. Conversely, a lower D/E ratio suggests that a company is less reliant on debt, which can be a sign of financial stability.

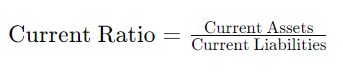

4. Current Ratio

What is it?

The Current Ratio is a liquidity ratio that measures a company’s ability to pay short-term obligations with its current assets.

How to Calculate It:

Why It Matters:

A current ratio of less than 1 indicates that a company may struggle to meet its short-term obligations, while a ratio above 1 suggests that it has enough assets to cover its liabilities. However, an excessively high current ratio may indicate inefficiencies in utilizing assets.

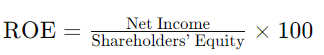

5. Return on Equity (ROE)

What is it?

Return on Equity (ROE) measures a company’s ability to generate profits from its shareholders’ equity.

How to Calculate It:

Why It Matters:

A high ROE indicates that a company is effectively using its equity base to generate profits. Investors often look for companies with consistently high ROE, as it suggests good management and a potentially strong investment.

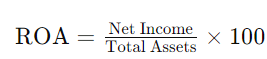

6. Return on Assets (ROA)

What is it?

Return on Assets (ROA) measures a company’s ability to generate profit from its assets.

How to Calculate It:

Why It Matters:

ROA is a useful indicator of how efficiently a company is utilizing its assets to produce profit. A higher ROA indicates better asset management, which can be a sign of a solid investment.

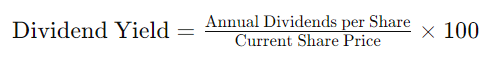

7. Dividend Yield

What is it?

The Dividend Yield ratio shows how much a company pays in dividends relative to its stock price.

How to Calculate It:

Why It Matters:

For income-focused investors, a higher dividend yield can be attractive, as it indicates a good return on investment through dividends. However, a very high yield may signal underlying problems within the company, so it’s essential to consider the company’s overall financial health.

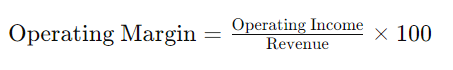

8. Operating Margin

What is it?

Operating Margin measures the percentage of revenue that remains after covering operating expenses.

How to Calculate It:

Why It Matters:

A higher operating margin indicates that a company is more efficient at converting sales into profits. This ratio is crucial for assessing the profitability of a company’s core business operations and can help identify companies with strong competitive advantages.

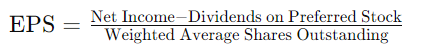

9. Earnings Per Share (EPS)

What is it?

Earnings Per Share (EPS) is a key financial metric that indicates how much profit a company generates per share of its stock.

How to Calculate It:

Why It Matters:

EPS is a critical indicator of a company’s profitability and is often used in calculating other ratios, such as the P/E ratio. Increasing EPS over time can be a positive sign for investors, indicating growth in profits.

10. Free Cash Flow (FCF)

What is it?

Free Cash Flow (FCF) measures the cash a company generates after accounting for capital expenditures needed to maintain or expand its asset base.

How to Calculate It:

FCF=Operating Cash Flow−Capital Expenditures

Why It Matters:

FCF is a crucial indicator of a company’s financial health, as it shows how much cash is available for expansion, debt repayment, or returning capital to shareholders through dividends and share buybacks. Positive FCF can signal that a company is in good financial standing.

Conclusion

Understanding these key financial ratios is essential for any investor looking to make informed decisions in the stock market. By analyzing these metrics, you can gain valuable insights into a company’s financial health, operational efficiency, and growth potential. Remember, while ratios are powerful tools, they should not be the sole basis for investment decisions. It’s crucial to consider the overall context of the company, industry trends, and macroeconomic factors. Combining these ratios with qualitative analysis can lead to a more comprehensive evaluation and better investment outcomes. Happy investing!

You might also be interested in – How to Calculate Turnover for F&O Trading