Amitabh Bachchan Acquires Stake in Swiggy Amid IPO Plans

SoftBank-backed Swiggy, a prominent player in the food delivery and quick commerce sector, is setting its sights on a valuation of approximately $15 billion for its upcoming initial public offering (IPO). The company aims to raise between $1 billion and $1.2 billion through this significant market debut, positioning itself as one of the largest Indian IPOs of the year.

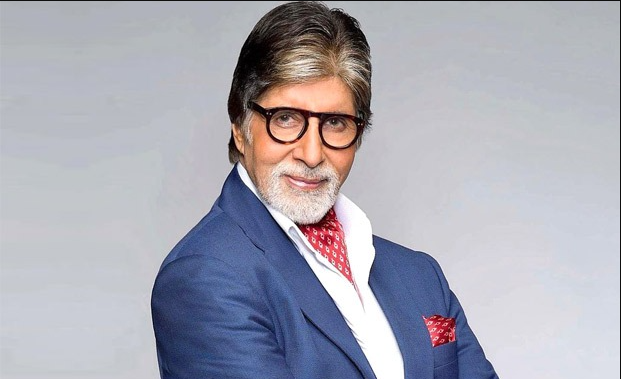

In a noteworthy development, Amitabh Bachchan, the renowned Bollywood icon, has reportedly acquired a small stake in Swiggy. This investment by Bachchan’s family office comes at a pivotal moment, as Swiggy gears up for its IPO, with a target valuation of $15 billion. The involvement of such a high-profile investor underscores the growing interest in the company’s future prospects.

Amitabh Bachchan’s Investment in Swiggy

According to The Economic Times, Amitabh Bachchan’s family office has purchased shares from Swiggy’s employees and early investors. Although the exact amount of the investment has not been disclosed, it is expected to be a substantial sum. This move highlights Bachchan’s confidence in Swiggy’s potential and adds a notable endorsement to the company’s IPO preparations.

The report also mentions that Raamdeo Agrawal, Chairman of Motilal Oswal Financial Services, has acquired a stake in Swiggy. Agrawal’s investment extends to the quick-commerce sector as well, with his recent involvement in Zepto’s $665 million funding round. These secondary share transactions, including Bachchan’s investment, are believed to have been executed at a valuation of around $10-11 billion, reflecting a significant market interest in Swiggy.

Swiggy’s IPO and Market Strategy

Swiggy’s upcoming IPO is anticipated to be a major event in the Indian financial landscape. With plans to raise up to $1.25 billion, the IPO is expected to secure a valuation of approximately $15 billion. This would make Swiggy’s stock market debut one of the largest in India this year, underlining the company’s strong market position and growth potential.

Competing directly with Zomato in India’s online food delivery market, Swiggy has also made strides into the quick commerce sector. The company now offers rapid 10-minute delivery for groceries and other products through its Instamart service. This expansion into quick commerce represents a significant strategic move, aiming to capture a growing segment of the market that is becoming increasingly important.

In April, Swiggy received shareholder approval for its IPO, allowing it to raise up to $1.25 billion. The company’s confidential filing is expected to be reviewed by the Indian markets regulator shortly. The proceeds from the IPO are slated to be invested in scaling up Swiggy’s Instamart business and expanding its warehouse network, which is crucial for supporting its quick commerce operations.

Swiggy’s valuation was pegged at $10.7 billion during its last funding round in 2022, led by Invesco. The company’s food delivery service has proven profitable, while its Instamart segment continues to operate at a loss. Despite this, Swiggy’s extensive network of around 550 grocery warehouses across 35 Indian cities positions it strongly within the competitive landscape of online grocery retail.

Goldman Sachs has projected that quick deliveries will comprise $5 billion of India’s $11 billion online grocery market, with expectations for this segment to dominate 70% of the market by 2030. This growth trajectory underscores the potential for Swiggy’s quick commerce segment to become a significant contributor to the company’s overall success.

Amitabh Bachchan’s investment in Swiggy highlights the increasing confidence in the company’s potential as it prepares for one of the year’s largest IPOs. As Swiggy aims for a valuation of $15 billion, the involvement of high-profile investors like Bachchan and Agrawal signals strong market interest and optimism about the company’s future. With a strategic focus on both food delivery and quick commerce, Swiggy is set to play a pivotal role in shaping the future of India’s online retail landscape.

You might also be interested in – Swiggy Plans to Submit its Draft Red Herring Prospectus by September: Report