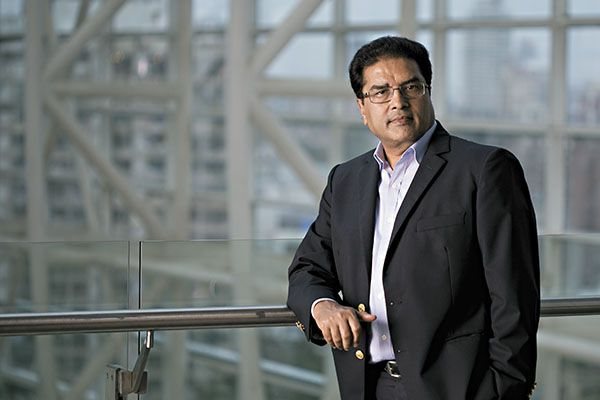

Raamdeo Agrawal, the billionaire investor known for his expertise in stock-picking, has recently made headlines by acquiring stakes in IPO-bound Swiggy and Zepto. This move highlights Agrawal’s increasing interest in emerging businesses, especially in the burgeoning quick-commerce sector. According to a report, Agrawal’s investments come at a time when fundraising in the quick-commerce industry is experiencing a significant surge.

Agrawal’s Strategic Move into IPO-bound Swiggy and Zepto

Agrawal’s stake in IPO-bound Swiggy and Zepto underscores his strategic focus on new-age businesses that are disrupting traditional industries. Both companies are at the forefront of the quick-commerce sector, which is rapidly evolving and capturing substantial market share. The investment in Swiggy, a leading food delivery and quick-commerce company, is particularly notable. Swiggy, which is valued between $10-11 billion, continues to strengthen its position in the market as it gears up for its IPO. Agrawal’s involvement reflects his confidence in Swiggy’s potential to maintain its strong market presence and capitalize on the growing demand for quick-commerce solutions.

Similarly, Zepto, which recently secured $665 million in funding, is another key player in the quick-commerce industry. This substantial funding round further solidifies Zepto’s influence and potential within the sector. Agrawal’s investment in Zepto aligns with his positive outlook on the growth prospects of quick-commerce companies, which are transforming the way consumers access goods and services.

Amitabh Bachchan’s Family Office Joins the Investment Trend

Adding to the momentum, the family office of Bollywood superstar Amitabh Bachchan has also invested in IPO-bound Swiggy. This investment was made by acquiring shares from the company’s employees and early investors, indicating a broader confidence in the quick-commerce sector. Bachchan’s family office’s involvement underscores the growing appeal of quick-commerce companies among high-profile investors, further validating the sector’s potential for substantial returns.

Agrawal’s Bullish Outlook on New-Age Businesses

Raamdeo Agrawal’s investment in IPO-bound Swiggy and Zepto reflects his bullish outlook on new-age businesses. Agrawal has expressed considerable optimism about the growth potential of companies in the quick-commerce sector, highlighting firms like Zomato, which are expanding rapidly at annual rates of 70-80%. Despite this optimism, Motilal Oswal Mutual Fund, where Agrawal plays a significant role, has recently reduced its stake in Zomato following a notable rally in its stock price. Nevertheless, Motilal Oswal continues to hold a positive view of the industry’s future.

Zomato’s Future and the Impact of Quick Commerce

Motilal Oswal Financial Services maintains a “buy” rating on Zomato, setting a target price of ₹300. This valuation is driven by factors such as Blinkit’s rapid growth and the transformative nature of quick commerce. The continued success of quick-commerce companies like Zomato and Blinkit highlights the sector’s disruptive impact on traditional retail and delivery models, reinforcing Agrawal’s investment strategy.

The Promising Future of IPO-bound Swiggy and Zepto

Agrawal’s investments in IPO-bound Swiggy and Zepto emphasize his confidence in the long-term prospects of the quick-commerce sector. As these companies prepare for their IPOs, their ability to adapt to changing market dynamics and capitalize on evolving consumer preferences will be crucial. The quick-commerce sector is poised for significant growth, and Agrawal’s strategic investments reflect a broader trend of increasing interest in businesses that are redefining industry standards.

In summary, Raamdeo Agrawal’s recent investments in IPO-bound Swiggy and Zepto highlight his strategic focus on the quick-commerce sector, which is rapidly expanding and reshaping traditional business models. With significant backing from high-profile investors and a positive outlook on the industry’s growth, quick-commerce companies are set to play a pivotal role in the future of commerce.

You might also be interested in- LG Electronics CEO suggests a potential IPO for its Indian subsidiary, coinciding with Hyundai’s Rs 25,000 crore investment plan