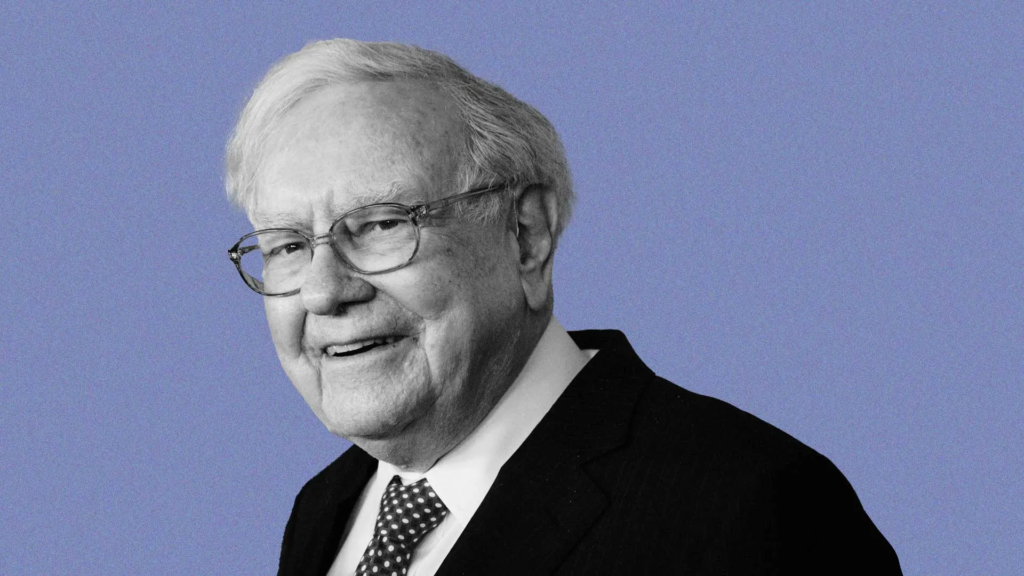

Warren Buffett, often referred to as the “Oracle of Omaha,” has established himself as one of the most successful and respected investors of all time. His investment company, Berkshire Hathaway, holds a portfolio worth hundreds of billions, strategically allocated across various sectors. For investors, the details of Berkshire Hathaway’s top holdings offer a glimpse into Buffett’s value-investing philosophy and long-term focus on quality companies. Here, we delve into the top holdings that have consistently contributed to Berkshire Hathaway’s incredible growth.

1. Apple Inc. (AAPL)

- Investment Value: Approximately $125 billion (as of the latest filings)

- Portfolio Share: Nearly 50% of Berkshire Hathaway’s portfolio

Apple remains the largest holding in Buffett’s portfolio, with the tech giant making up a significant portion of Berkshire Hathaway’s total stock investments. Although Buffett was historically cautious about technology stocks, his investment in Apple reflects his belief in its enduring brand loyalty, strong cash flows, and exceptional management. Apple’s regular stock buybacks and dividends have proven to be financially rewarding, aligning with Buffett’s preference for companies that return capital to shareholders.

2. Bank of America (BAC)

- Investment Value: Approximately $33 billion

- Portfolio Share: Around 10%

Financial institutions have long been a cornerstone in Buffett’s investment strategy, and Bank of America stands as his second-largest holding. With over 1 billion shares, Berkshire Hathaway is one of Bank of America’s largest shareholders. Buffett’s confidence in the bank stems from its strong market position, prudent management, and substantial dividend payments. He views Bank of America as a financial giant with robust capital, offering the potential for long-term growth even in times of economic fluctuation.

3. American Express (AXP)

- Investment Value: Approximately $26 billion

- Portfolio Share: Close to 8%

Buffett’s relationship with American Express dates back to the 1960s, and he has maintained a stake in the company through various economic cycles. As one of the world’s largest credit card companies, American Express has carved a niche among affluent customers and businesses, leading to a loyal user base and stable revenue. Buffett appreciates American Express’s unique business model, which combines financial services with brand value and exclusivity—a combination that consistently delivers solid returns on investment.

4. Coca-Cola (KO)

- Investment Value: Approximately $23 billion

- Portfolio Share: About 7%

Coca-Cola is one of Buffett’s longest-held investments, with Berkshire Hathaway owning the stock since the 1980s. Buffett’s love for Coca-Cola is both personal and professional—he’s known for drinking multiple cans a day! As an investment, Coca-Cola represents Buffett’s classic approach to value investing: it’s a globally recognized brand with consistent earnings, a solid dividend yield, and a business model that remains relatively stable over time. For decades, Coca-Cola has delivered shareholder value, making it a pillar in Berkshire’s portfolio.

5. Chevron Corporation (CVX)

- Investment Value: Approximately $21 billion

- Portfolio Share: Nearly 6%

As a major player in the energy sector, Chevron’s substantial share of Berkshire Hathaway’s portfolio marks Buffett’s confidence in the oil and gas industry. Despite Buffett’s reservations about climate change impacts on fossil fuels, Chevron’s significant cash flow and dividend yield make it an attractive investment. Buffett’s approach with Chevron underscores his belief in the long-term demand for energy and the company’s resilience in adapting to market conditions.

6. The Kraft Heinz Company (KHC)

- Investment Value: Approximately $10 billion

- Portfolio Share: About 3%

Kraft Heinz represents one of Berkshire’s more mixed outcomes. Buffett initially invested in the company due to its strong brand presence and large consumer base. Although Kraft Heinz faced some operational challenges, Berkshire has held on to its stake, believing in the potential for the company to reposition itself in the evolving food industry. Kraft Heinz remains a prominent holding, and Berkshire continues to work closely with the company’s management.

7. Moody’s Corporation (MCO)

- Investment Value: Approximately $8 billion

- Portfolio Share: About 2.5%

Moody’s, a global leader in financial services and credit ratings, has been a quiet yet significant part of Buffett’s portfolio. As a dominant credit-rating agency, Moody’s benefits from a near-monopoly on credit risk assessment. Its consistent profitability and lack of direct competitors give it a unique market position, aligning with Buffett’s preference for businesses with enduring competitive advantages.

8. Occidental Petroleum Corporation (OXY)

- Investment Value: Approximately $7 billion

- Portfolio Share: Around 2%

Similar to Chevron, Occidental Petroleum is an energy investment that reflects Buffett’s strategy of capitalizing on stable cash flow in the oil sector. In recent years, Buffett increased his stake in Occidental significantly, demonstrating his faith in the company’s management and its role in the global energy market. Buffett’s investments in energy show his confidence in the industry’s resilience, even as the world transitions to renewable energy sources.

9. HP Inc. (HPQ)

- Investment Value: Approximately $5 billion

- Portfolio Share: About 1.5%

HP Inc., a leading manufacturer of computers and printers, was a more recent addition to Berkshire Hathaway’s portfolio. HP’s ability to consistently generate cash and its efforts to diversify beyond traditional printing make it appealing. While relatively small compared to his other holdings, Buffett’s stake in HP showcases his continued interest in diversified, stable companies with strong fundamentals.

10. Charter Communications (CHTR)

- Investment Value: Approximately $4 billion

- Portfolio Share: Close to 1.5%

Charter Communications, one of the largest cable and broadband providers in the U.S., rounds out Buffett’s top 10 holdings. Despite the shifting landscape in telecommunications, Charter’s broadband service and internet infrastructure continue to generate steady revenue. Buffett values Charter’s large customer base and sees opportunities in the sector’s growth, especially as broadband demand continues to rise in an increasingly digital world.

Why These Holdings? Buffett’s Investment Principles in Action

Buffett’s portfolio is a testament to his investing philosophy, which emphasizes long-term growth, stability, and shareholder value. A few key takeaways from his approach include:

- Preference for Strong Brands: Buffett is drawn to companies with lasting brand power, such as Apple, Coca-Cola, and American Express, as these entities often yield consistent cash flows.

- Dividend-Paying Stocks: Companies like Apple, Bank of America, and Chevron are known for their generous dividends, aligning with Buffett’s desire for income-generating investments.

- Economic Moats: The presence of durable competitive advantages, or “moats,” is a recurring theme, with companies like Moody’s and Coca-Cola exemplifying this quality.

- Diversification across Industries: While financials and consumer staples are heavily represented, Buffett’s portfolio also includes technology, energy, and telecommunications, reflecting his belief in a balanced approach to risk.

Conclusion: The Wisdom in Buffett’s Holdings

Warren Buffett’s top holdings showcase his belief in value, quality, and durability. For investors, understanding these choices offers valuable lessons in fundamental analysis, patience, and the benefits of long-term investing. While many investors seek short-term gains, Buffett’s success lies in his ability to identify and hold stocks that provide sustainable returns. As Berkshire Hathaway’s portfolio continues to evolve, these core holdings highlight the enduring appeal of Buffett’s investment approach and the timeless principles that have made him a legend in the world of finance.

You might also be interested in – Warren Buffett’s Berkshire Hathaway has reduced its stake in Bank of America by 15%, amounting to $6 billion. But why?