Investing in mutual funds has become increasingly popular, thanks to the variety of options available to cater to different financial goals and risk appetites. Among these options, Systematic Investment Plans (SIPs), Systematic Transfer Plans (STPs), and Systematic Withdrawal Plans (SWPs) are three of the most widely used strategies. Each serves a distinct purpose and caters to specific financial needs, yet they are often misunderstood or confused with one another. In this blog, we will explore the differences between SIPs, STPs, and SWPs, shedding light on how each works, its benefits, and when it might be the best option for an investor.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds. With SIPs, investors contribute a fixed amount of money at regular intervals—usually monthly—into a mutual fund scheme. This method allows investors to build a corpus over time by taking advantage of the power of compounding and rupee cost averaging.

How SIPs Work

When you invest through a SIP, you buy units of a mutual fund scheme at the prevailing Net Asset Value (NAV) on the date of investment. Since the NAV fluctuates with market conditions, the cost of acquiring units varies with each installment. This variation is where rupee cost averaging comes into play; you end up buying more units when prices are low and fewer units when prices are high. Over time, this averaging can lead to a lower overall cost per unit.

Benefits of SIPs

- Disciplined Investing: SIPs promote regular investing, which is crucial for building wealth over the long term.

- Flexibility: Investors can start SIPs with as little as ₹500 per month, making it accessible for everyone.

- Rupee Cost Averaging: This approach reduces the impact of market volatility on your investments.

- Power of Compounding: Regular investments over a long period can significantly increase the corpus due to the compounding effect.

When to Use SIPs

SIPs are ideal for individuals who wish to invest in equity mutual funds for long-term goals such as retirement, children’s education, or buying a home. They are also suitable for those who prefer a hands-off approach to investing, where money is automatically deducted from their bank account and invested in the chosen scheme.

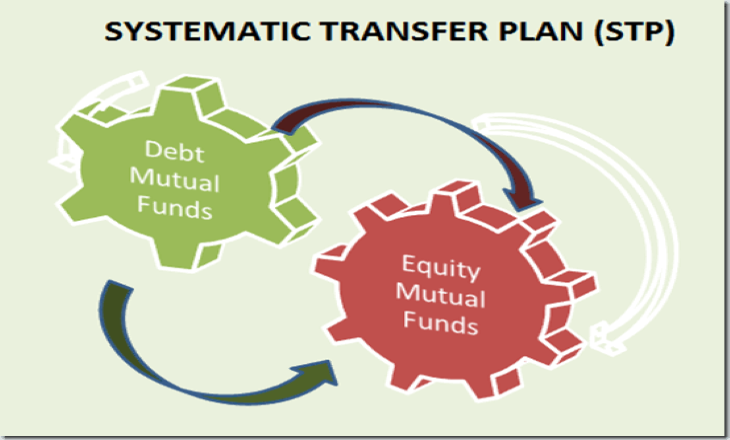

What is a Systematic Transfer Plan (STP)?

A Systematic Transfer Plan (STP) allows investors to transfer a fixed amount of money from one mutual fund scheme to another at regular intervals. Typically, investors move funds from a low-risk scheme, like a debt fund, to a higher-risk scheme, like an equity fund, to gradually shift their asset allocation according to their risk tolerance and market conditions.

How STPs Work

STPs work by setting up an automatic transfer from one mutual fund to another within the same fund house. For example, an investor might park a large sum in a liquid fund and systematically transfer a fixed amount into an equity fund over time. This strategy allows the investor to take advantage of market fluctuations and reduces the risk of investing a lump sum at a market peak.

Types of STPs

- Fixed STP: A fixed amount is transferred from one scheme to another at regular intervals.

- Capital Appreciation STP: Only the capital gains from the source fund are transferred to the target fund.

- Flexi STP: The amount transferred can vary based on market conditions or the investor’s preference.

Benefits of STPs

- Rupee Cost Averaging: Like SIPs, STPs help in averaging the purchase cost over time, reducing the impact of market volatility.

- Better Cash Flow Management: Investors can manage their cash flows better by systematically transferring funds from a liquid or debt fund to an equity fund.

- Risk Mitigation: By spreading investments over time, STPs help mitigate the risk of market timing.

When to Use STPs

STPs are ideal for investors who have a lump sum to invest but are wary of market volatility. They are also suitable for those looking to gradually shift their asset allocation from debt to equity or vice versa, depending on their changing risk appetite and market outlook.

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is a method that allows investors to withdraw a fixed amount of money from their mutual fund investments at regular intervals. This is particularly useful for those who require a steady income stream, such as retirees.

How SWPs Work

In an SWP, an investor sets up a plan to withdraw a specific amount of money from their mutual fund investment on a regular basis—monthly, quarterly, or annually. The withdrawn amount is typically transferred to the investor’s bank account, and units of the mutual fund are redeemed to facilitate the payout. The remaining investment continues to grow, subject to market conditions.

Benefits of SWPs

- Regular Income: SWPs provide a steady income stream, making them ideal for retirees or those needing regular cash flow.

- Tax Efficiency: In comparison to dividends, SWPs can be more tax-efficient, especially for long-term capital gains.

- Customizable Withdrawals: Investors can choose the withdrawal frequency and amount based on their needs and financial goals.

- Preservation of Capital: By withdrawing only a portion of the investment, the remaining capital continues to grow, potentially increasing the overall corpus.

When to Use SWPs

SWPs are best suited for individuals who require a regular income from their investments, such as retirees. They are also useful for those looking to supplement their income while preserving the capital invested in mutual funds. Additionally, SWPs can be part of a broader retirement planning strategy, providing financial stability without depleting the investment corpus too quickly.

Key Differences Between SIPs, STPs, and SWPs

While SIPs, STPs, and SWPs are all systematic investment tools offered by mutual funds, they serve different purposes and cater to different financial needs. Understanding these differences is crucial for making informed investment decisions.

Purpose

- SIP: Primarily used for regular investment in a mutual fund scheme to accumulate wealth over time.

- STP: Used to transfer money systematically from one mutual fund scheme to another, typically from a low-risk to a higher-risk fund.

- SWP: Designed to provide regular income by systematically withdrawing money from a mutual fund investment.

Investment vs. Withdrawal

- SIP: Focuses on investing small amounts regularly to build wealth.

- STP: Involves both investment and withdrawal, transferring funds from one scheme to another.

- SWP: Focuses on withdrawing money regularly, providing a steady income stream.

Risk Management

- SIP: Helps in managing risk through rupee cost averaging, making it suitable for long-term equity investments.

- STP: Helps in managing risk by gradually shifting investments from one fund to another, reducing the impact of market volatility.

- SWP: Manages risk by allowing partial withdrawals, preserving the remaining investment for potential growth.

Ideal For

- SIP: Investors looking to build a long-term investment portfolio with regular contributions.

- STP: Investors with a lump sum who want to invest gradually or shift their asset allocation over time.

- SWP: Investors needing regular income from their investments, such as retirees or those supplementing their income.

Combining SIPs, STPs, and SWPs in a Financial Plan

One of the most effective ways to manage your investments is to use SIPs, STPs, and SWPs in combination, depending on your financial goals, risk tolerance, and life stage.

Early Stage: Building Wealth with SIPs

For young investors or those just starting their investment journey, SIPs are an excellent way to begin. Regular investments in equity mutual funds can help build a substantial corpus over time, taking advantage of the power of compounding. SIPs also instill a disciplined investment habit, which is crucial for long-term wealth creation.

Mid-Life Stage: Strategic Allocation with STPs

As you accumulate wealth, you might want to rebalance your portfolio to align with your changing risk appetite and financial goals. STPs can be used to gradually shift from high-risk equity funds to more stable debt funds or vice versa, depending on your investment strategy. For instance, if you are approaching retirement, you might want to reduce exposure to equity and increase allocation to debt funds, which can be done effectively through STPs.

Retirement Stage: Regular Income with SWPs

In retirement, the focus shifts from wealth accumulation to income generation. SWPs provide a systematic way to withdraw money from your mutual fund investments, ensuring a steady income stream while allowing the remaining corpus to grow. This strategy helps in maintaining financial stability during retirement without depleting the investment corpus too quickly.

Conclusion: Choosing the Right Plan for Your Financial Goals

Understanding the differences between SIPs, STPs, and SWPs is essential for making informed investment decisions. Each of these systematic plans serves a unique purpose and can be a powerful tool when used correctly in your financial plan. Whether you are looking to build wealth, manage risk, or generate regular income, there is a systematic plan that can help you achieve your financial goals.

For most investors, a combination of SIPs, STPs, and SWPs can be the key to a well-rounded investment strategy. By integrating these plans based on your life stage and financial objectives, you can optimize your investments, manage risk effectively, and ensure a steady income stream when needed.

Always remember, while these systematic plans offer many benefits, it is important to align them with your overall financial goals, risk tolerance, and investment horizon. Consulting with a financial advisor can also provide valuable insights and help tailor these plans to your specific needs, ensuring that your investment strategy is both effective and aligned with your long-term goals.

You might also be interested in –Public sector undertakings (PSUs) HUDCO and Cochin Shipyard are among 13 companies that have been newly added to the FTSE All-World index.