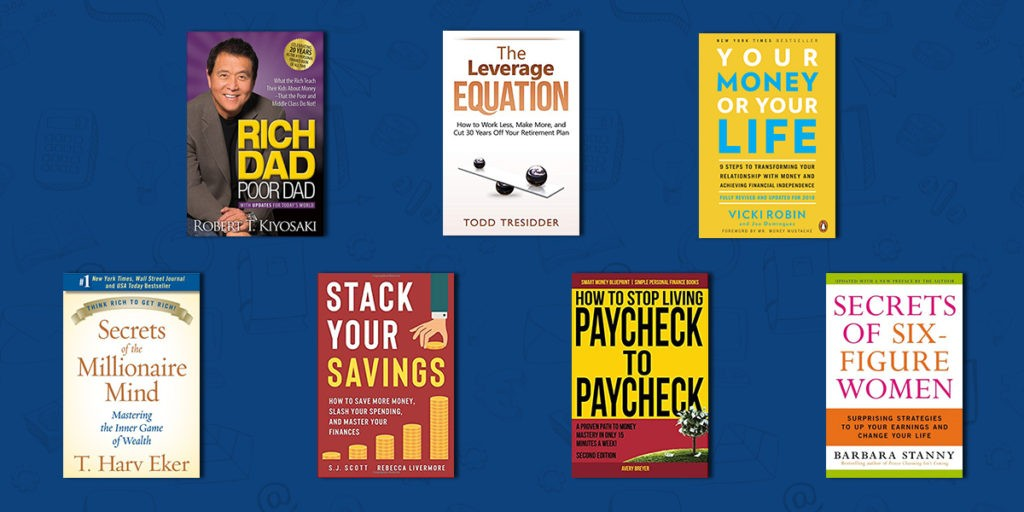

Personal finance is one of the most important aspects of modern life, yet many people struggle with managing their finances effectively. Whether you’re looking to get out of debt, save for a major purchase, or build long-term wealth, there are plenty of resources to help guide you. Among the most valuable are personal finance books written by experts who have spent their careers mastering money management, investment strategies, and financial independence. To help you get started, here are the 10 best personal finance books that can give you the knowledge and inspiration you need to take control of your finances.

1. “Rich Dad Poor Dad” by Robert T. Kiyosaki

One of the most popular personal finance books of all time, Rich Dad Poor Dad focuses on the difference in mindset between those who build wealth and those who remain financially stagnant. Kiyosaki tells the story of his two father figures: his biological father (the “poor dad”) and the father of his best friend (the “rich dad”). The book stresses the importance of financial education, investing in assets, and creating multiple income streams.

Kiyosaki’s central idea is that the traditional path—getting a good education, a steady job, and saving money—doesn’t necessarily lead to financial success. Instead, he promotes entrepreneurship, real estate investment, and understanding how money works in order to achieve financial independence. If you want a mindset shift about money, Rich Dad Poor Dad is an excellent place to start.

2. “The Total Money Makeover” by Dave Ramsey

Dave Ramsey is well-known for his practical, no-frills approach to personal finance. The Total Money Makeover lays out Ramsey’s seven-step plan for taking control of your finances, eliminating debt, and building wealth. Ramsey focuses heavily on the importance of living within your means, creating a budget, and using the “debt snowball” method to pay off debt quickly.

This book is great for individuals or families struggling with debt who want a straightforward, actionable plan. Ramsey’s method has been adopted by millions around the world, and his advice is particularly useful for people who are new to personal finance.

3. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Your Money or Your Life is a revolutionary guide to financial independence through mindful spending and reducing consumption. The authors argue that time is your most valuable resource, and that trading too much of it for money (through a job you don’t love, for example) is detrimental to both your happiness and financial well-being.

This book provides a detailed program for transforming your relationship with money, cutting expenses, and creating a fulfilling life that isn’t dominated by the need to earn more. It encourages readers to view money as a tool to achieve freedom rather than just an end in itself.

4. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

The Millionaire Next Door dispels the myth that millionaires live flashy, high-consumption lifestyles. Instead, the authors found that many millionaires are regular people who live frugally, invest wisely, and build wealth over time. This book is based on a comprehensive study of millionaires in the United States, revealing that most wealthy individuals prioritize saving and investing over extravagant spending.

For those looking for long-term financial success, this book provides practical insights into the habits and behaviors that lead to wealth accumulation. The message is clear: living below your means and making smart financial choices can lead to millionaire status, even without a six-figure income.

5. “I Will Teach You to Be Rich” by Ramit Sethi

Ramit Sethi’s I Will Teach You to Be Rich is a highly practical guide to managing your money, particularly for young adults. With his signature humor and straightforward style, Sethi covers everything from setting up bank accounts and automating your finances to investing in the stock market and negotiating better deals on everything from credit cards to rent.

What makes this book stand out is its emphasis on actionable steps. Sethi provides a six-week plan to get your financial life in order, making it accessible for beginners. It’s a great starting point for anyone looking to take control of their finances without feeling overwhelmed.

6. “The Psychology of Money” by Morgan Housel

In The Psychology of Money, Morgan Housel delves into the behavioral aspects of finance. He argues that personal finance success is not just about knowing the right information but also about understanding how emotions and behaviors impact financial decisions. Housel uses a collection of short stories to illustrate key principles, such as why people make irrational financial choices and how to avoid common money traps.

This book is less about numbers and more about the mindset required to achieve financial success. It’s an insightful read for anyone interested in how psychology affects their financial habits.

7. “The Simple Path to Wealth” by JL Collins

Originally written as a series of letters to his daughter, JL Collins’ The Simple Path to Wealth simplifies investing in a way that is accessible to everyone. Collins advocates for low-cost index fund investing as the easiest and most reliable way to build long-term wealth. He explains how compound interest works, why you should avoid debt, and how to achieve financial independence.

For those who find investing intimidating or confusing, this book offers clear, actionable advice. Collins’ approach is rooted in simplicity and discipline, making it perfect for both beginners and seasoned investors.

8. “Broke Millennial” by Erin Lowry

Targeted at millennials, Broke Millennial is a relatable guide to personal finance for young adults navigating issues like student loans, budgeting, and investing for the first time. Erin Lowry’s friendly, conversational tone makes complex financial topics easy to understand, and she offers practical tips for tackling financial challenges head-on.

Lowry also covers emotional aspects of money, such as how to talk about finances with friends, family, and partners. This book is ideal for anyone in their 20s or 30s who feels overwhelmed by financial decision-making.

9. “The Barefoot Investor” by Scott Pape

Australian financial advisor Scott Pape’s The Barefoot Investor provides a step-by-step guide to managing your finances using a “bucket” system for budgeting, saving, and investing. Pape’s approach is simple and accessible, and he focuses on financial independence, paying off debt, and making smart long-term investments.

Although the book is primarily targeted at an Australian audience, its principles are universal, making it a valuable resource for anyone looking to build financial security.

10. “Think and Grow Rich” by Napoleon Hill

One of the most influential self-help books of all time, Think and Grow Rich was published in 1937 and is based on Napoleon Hill’s study of successful individuals like Henry Ford, Andrew Carnegie, and Thomas Edison. The book outlines 13 principles for achieving wealth and success, combining personal finance strategies with mindset techniques.

While some of the language may feel dated, the book’s core ideas about the power of positive thinking, goal setting, and perseverance remain relevant today. Think and Grow Rich is a must-read for anyone looking to cultivate a success-oriented mindset.

Conclusion: The Road to Financial Freedom

These 10 best personal finance books offer a wealth of knowledge on everything from budgeting and debt management to investing and building long-term wealth. Whether you’re just starting your financial journey or looking to fine-tune your strategy, these books provide valuable insights and actionable steps to help you achieve your financial goals.

By learning from the experiences and advice of seasoned experts, you can develop a better understanding of money, adopt healthier financial habits, and ultimately gain financial independence. The key to success lies in taking control of your finances and making informed decisions that align with your long-term goals. So, pick up one of these books, start reading, and take the first step toward mastering your money.

You might also be interested in – How to Calculate Turnover for F&O Trading